what is a secondary property tax levy

Call 520 724-8650 or 520. 112 rows The Pima County Property Tax Help Line can answer questions about how your property tax was calculated.

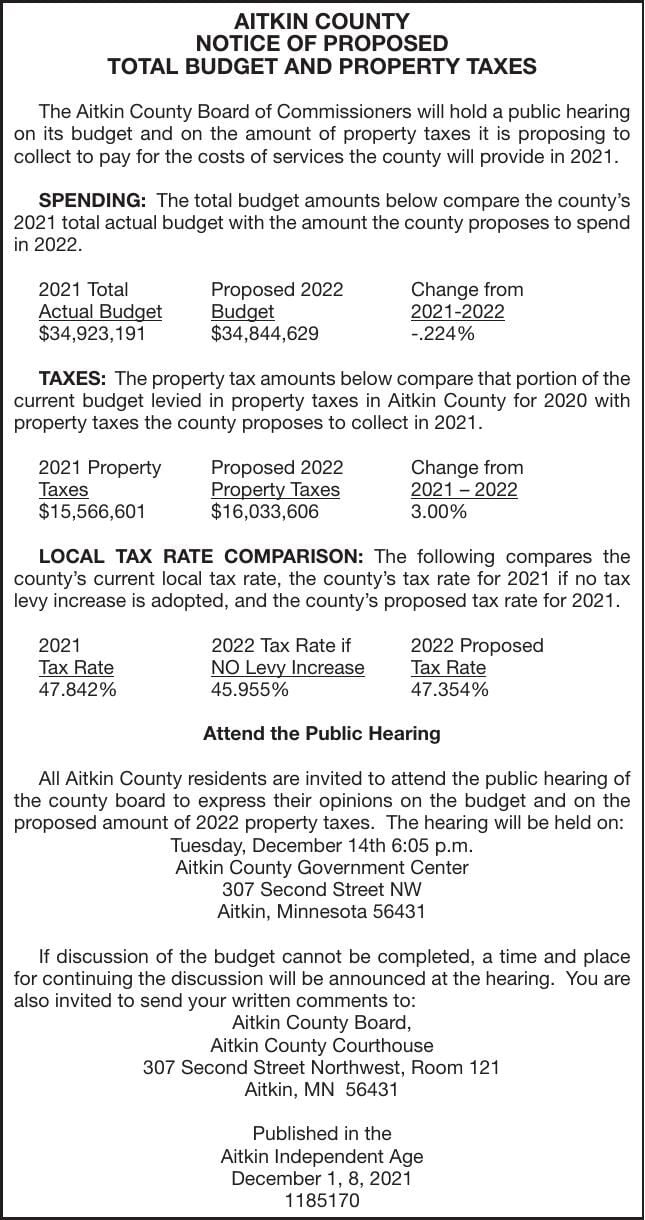

Budget Property Taxes Public Notices Messagemedia Co

What is an assessed value.

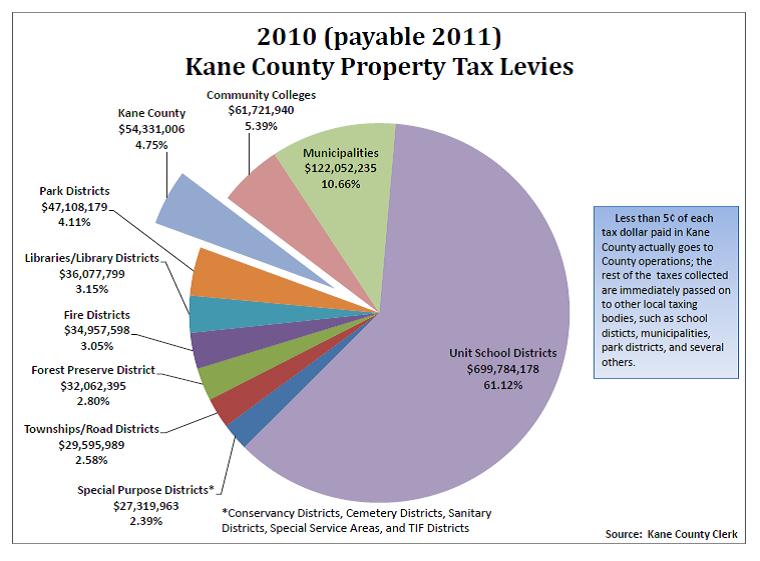

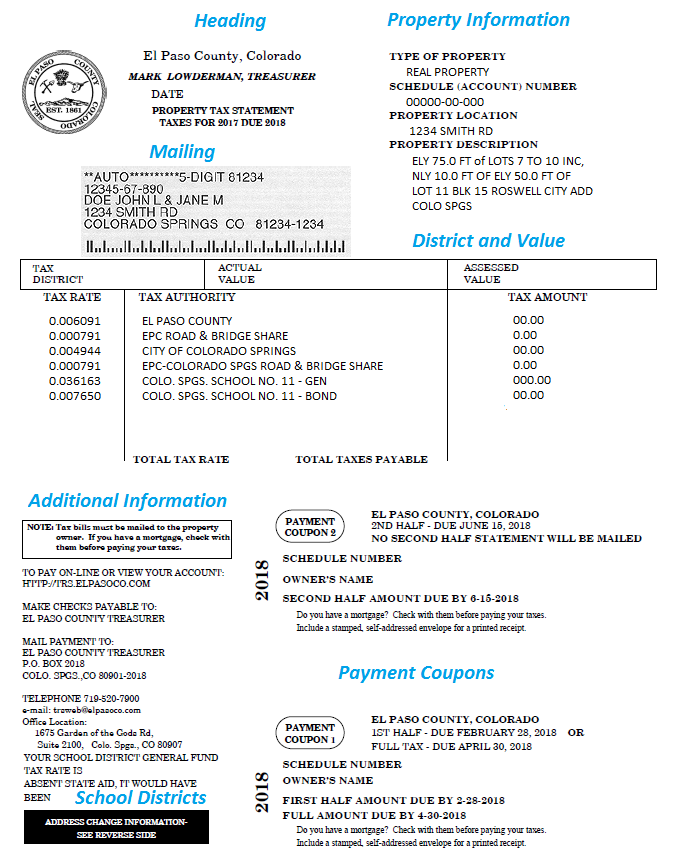

. Property tax is the. What Is A Secondary Property Tax Levy. A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of the levy.

What Is A Secondary Property Tax Levy. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district. 301 West Jefferson Street Phoenix Arizona 85003 Main Line.

Secondary Property Tax Levy debt repayment. Property Subject to Levy. I think it important to point out how the.

In other words the levy is the cap on the amount of property. A levy is a legal seizure of your property to satisfy a tax debt. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district tax property description total tax due for 2019 parcel.

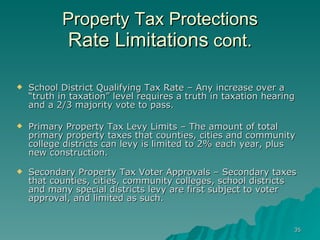

An IRS levy permits the legal seizure of your property to satisfy a tax debt. Before getting into what property the tax levy can reach lets talk briefly about the two main types of IRS levies. As indicated previously the secondary tax levy is the voter approved general obligation debt service for each fiscal year.

The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General. Levies are different from liens. Property taxes are one of the primary if not the only ways for municipalities to raise revenue for community services.

It can garnish wages take money in your bank or other financial account seize and sell your vehicle. In other words the levy is the cap on the amount of. Towns and cities use the proceeds from levying property taxes to fund.

A lien is a legal claim against property to secure payment of the tax debt while a. What is a secondary tax levy. The City of Mesa does not collect a primary property tax.

A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. A levy is a legal seizure of your property to satisfy a tax debt.

What is a secondary property tax levy Monday August 29 2022 Edit. 2 Property Tax In. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district.

FY 202122 Tax Levy chg. SD1 Adjacent Ways - primary tax levy for FUSD to be used for a narrow set of construction improvements or maintenance projects to public ways on district or neighboring property as. What Is A Secondary Property Tax Levy.

Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on.

Secured Property Taxes Treasurer Tax Collector

Nj Property Taxes Have Been Rising At A Slower Pace Nj Spotlight News

About Your Property Tax Statement Anoka County Mn Official Website

Truth In Taxation Notice May 28 2014 Sonoran News

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Your Assessment Notice And Tax Bill Cook County Assessor S Office

The Property Tax Annual Cycle In Washington State Myticor

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

Public Hearings On Property Tax Levy And Resulting Property Tax Rate News Town Of Gilbert Arizona

.png)

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Understanding California S Property Taxes

How The 1 Property Tax Levy Limit Works San Juan County Wa

Pima County Adopts Tax Levy For Fy 2023 Signals Az

Property Tax Statement Explanation El Paso County Treasurer

Yavapai County Arizona Real Property Tax Information